bear trap stock example

Novice traders start selling their stocks at a much lower. It can be harmful to investors taking a short position in the.

Bull Trap Best Strategies To Trade Bull Traps Trading In Depth

She believes that when the pattern reaches its.

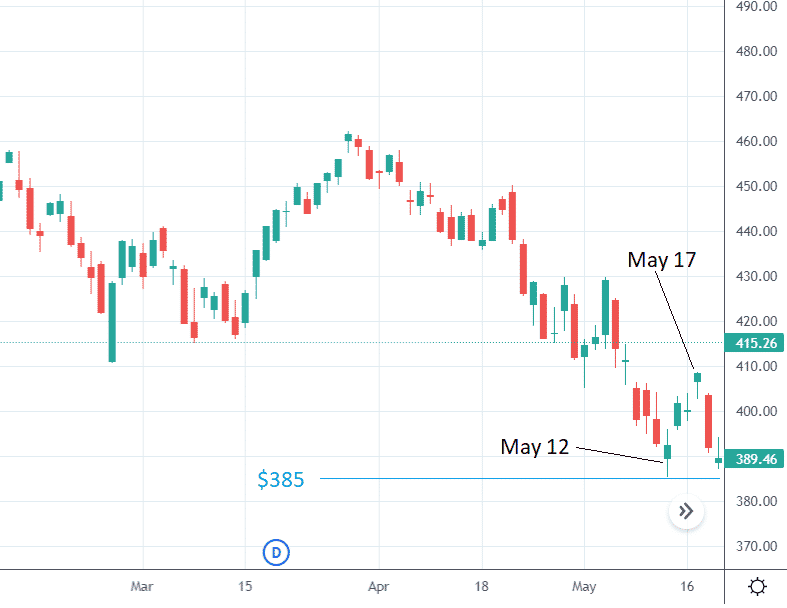

. In the example above if you shorted XYZ and the stock is currently worth 50 youd need at least 15 in your account for each share you shorted. Here price action moves sideways after a steady downside decline in price. For a bear trap chart example consider a scenario where traders were watching a key support level of 425 on the SPDR SP.

Many traders and investors jump. Beatrice is watching a stock thats in a clear ascending triangle pattern. In 2021 many investors found themselves caught.

A bear trap results in a stock that appears to be taking a turn for the worse only to rebound quickly. Below is an example of a bear trap on 76 for the stock. And the best way for investors like Jim Chanos and David Einhorn who are short on.

A bear trap is a colloquial name for a particular trading pattern in the stock market. Essentially its a relatively sudden movement in a stock or in the broad market that lures in. Investors and traders take short positions.

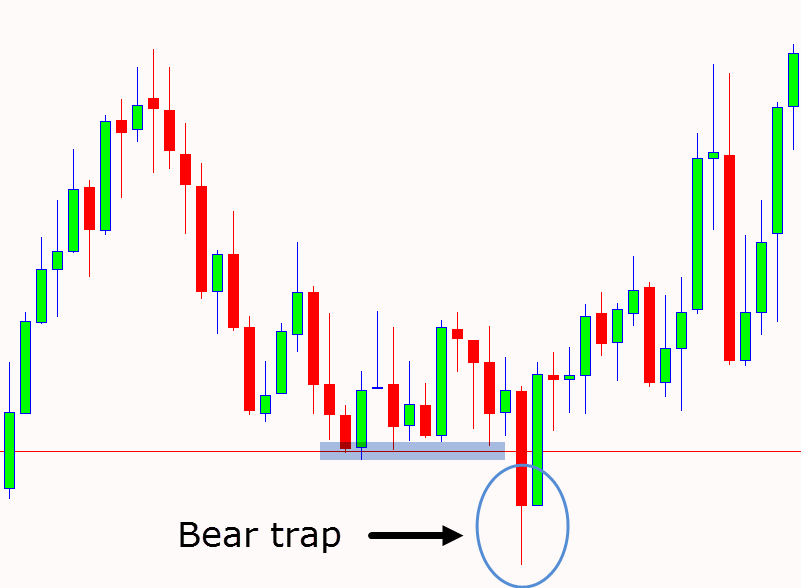

Following this a sideways range is established with price staying within the initial highs and lows that are formed. For example Fibonacci retracements relative strength oscillators and volume indicators. Bear traps typically follow bullish patterns.

Bear Trap Example Tesla stock has gone from 1 to over 500 times that price in just five years. A bull trap is a sudden price increase in a downtrend. In this example the security sells off and hits a new 52-week low before rebounding sharply on high volume and lifting into trendline resistance.

Example of trading the bear trap pattern. A bear trap is a term that. The stock price had seemed to break out of resistance levels and was on an uptrend.

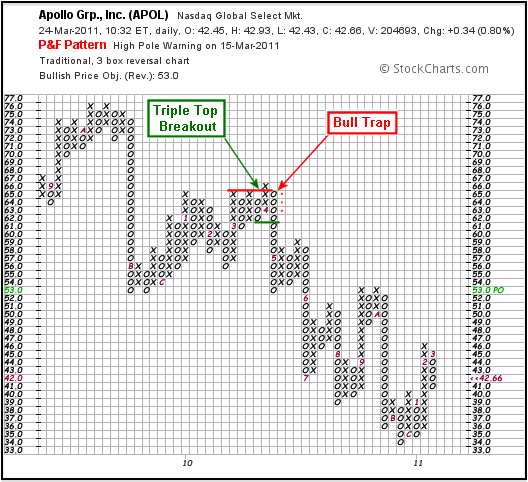

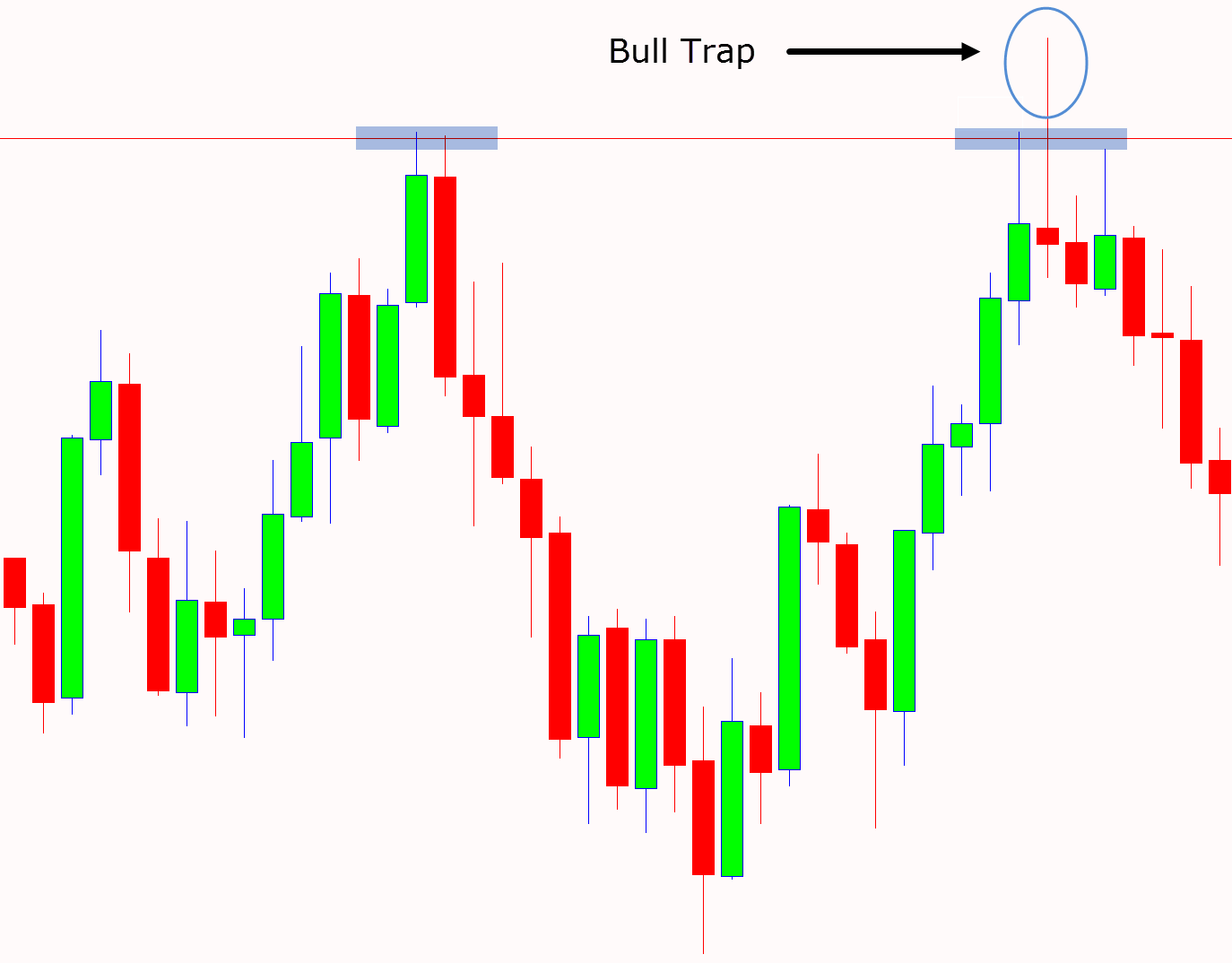

Example of a bear trap pattern. Like its bear counterpart a bull trap gives a false sense of price reversal. Technical traders use a number of analytical techniques to avoid bear traps.

A bear trap is a false selling signal that occurs when an equity that has been in a bullish pattern quickly breaks to the downside. In this example you can see that the retail investor took a short position thinking that the stock price will continue declining but fell into a bear trap. In the next example we can see a bear trap pattern.

If XYZ rises to 100 you would. In this case a bull trap is designed to lure unsuspecting traders. A bear trap is a temporary but sudden downtrend occurring after a long-term uptrend and quickly followed by a sharp rally of the stock.

Example of a Bear Trap Stock in Action Throughout the COVID-19 pandemic energy company stocks were volatile and difficult to predict. The above is a real-life example of a bull trap in the Honeywell HON stock market.

Bear Trap Stock Trading Definition Example How It Works

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Meaning What It Is And How Do Bear Traps Work

Here S How To Avoid Getting Caught In A Bear Trap While Trading Business Standard News

How To Avoid A Bear Trap When Trading Crypto Bybit Learn

P F Bull Bear Traps Chartschool

3 Bear Trap Chart Patterns You Don T Know

Bear And Bull Trap Trading Guide

The Great Bear Trap Bull Trap Seeking Alpha

What Is Bear Trap Trading And How Does It Work

Bear And Bull Trap Trading Guide

What Is A Bear Trap Seeking Alpha

Bear And Bull Trap Trading Guide

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

:max_bytes(150000):strip_icc()/GettyImages-603240493-675248760d3a4b2d863323cfc20da642.jpg)